General : How Holding Accounts and Vouchers Interact with GL Code Reporting

Article Contents: This article explaings how holding accounts and vouchers interact with GL code reporting.

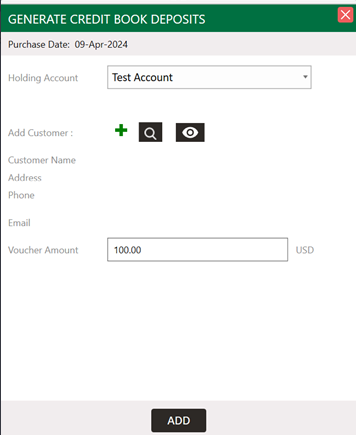

Step 1: Deposit into Credit Book Holding Account.

This should be looked at as the deposit into the holding account.Example: Depositing $100 into a test account using the “Credit Book Deposit” button. Paid for via check.

GL Code Report shows the following:

A) Type: Check Payment

Memo Note: Total Check Collected.

What is this? It is the $100 coming from the payment method check that I used to tender out the above order.

B) Type: Credit Book Holding Account Voucher Sale.

Memo Note: Credit book holding account vouchers sold for that day.

What is this? It is the $100 in credit being created in the holding account.

Step 2: Credit Book Holding Account Distribution to Individual Vouchers.

This should be looked at as the payment from the holding account to an individual credit book.

Example: I am going to distribute to 3 individual vouchers for $70, $20, and $10 for a total of $100.

GL code report shows the following:

A) Type: Credit Book Voucher Sale.

Memo Note: Credit book vouchers sold for that day

What is it? It Is the $100 being moved to the individual vouchers.

B) Type: Credit Book Holding Account Voucher Payments.

Memo Note: Total payments made using credit book holding account vouchers.

What is it? It is the $100 being deducted from the credit book holding account.

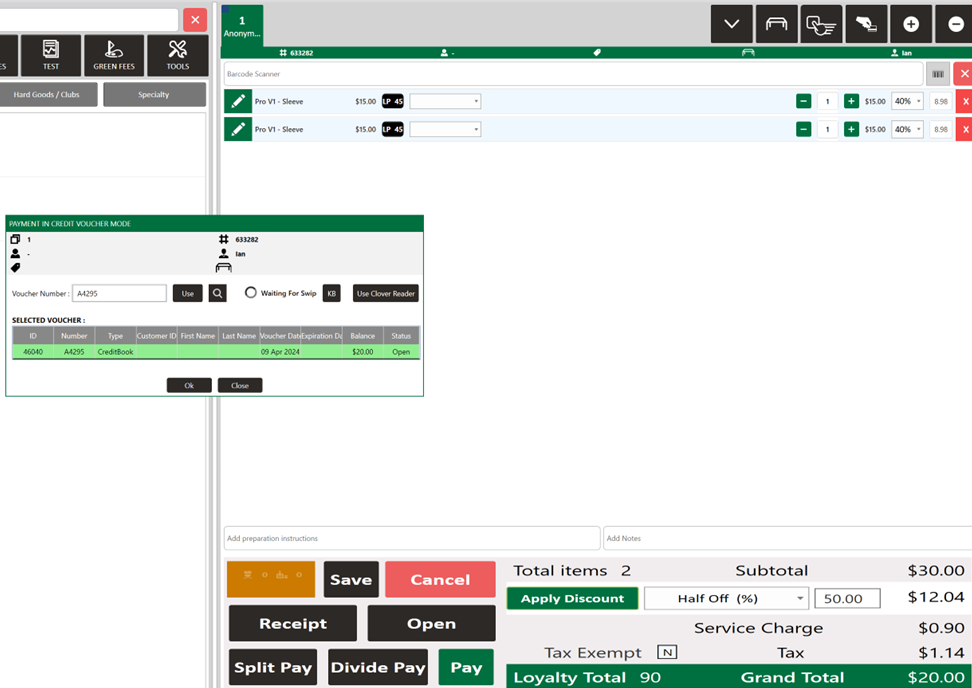

Step 3: Sales of items by redeeming individual vouchers.

Example: I have created an order with a pair of Pro V1 Sleeves and am redeeming a previously created voucher for the full balance.

GL Code Report shows the following:

GL code report shows the following:

A) Type: Sub Department - Golf Balls

Memo: Pro-Shop Golf Balls

What is it? The merchandise portion of our sale

- B) Type: Credit Book Voucher Payments.

Memo: Total payments made using credit book vouchers

What is it? This is the $20 debit from the voucher reallocating to the Credit accounts listed in this transaction.

C) Type: Sales Tax Payable.

Memo: Sales Tax – Sales – Pro-shop

What is it? The tax portion of our sale.

D) Type: Service Charge

Memo: Total service charge collected pro-shop

What is it? The service charge portion of our sale if applicable.

Step 4: Deposit to Existing Vouchers.

If you are reloading a specific voucher utilizing the “Voucher deposit” option in the tools section of the register.

Example: I have gone ahead and created an order that is adding $100 to an existing credit book voucher and tendering out with the check payment type.

GL Code Report shows the following:

A) Type: Check Payment.

Memo Note: Total Check Collected.

What is this? It is the $100 coming from the payment method check that I used to tender out the above order.

B) Type: Credit Book Holding Account Voucher Sale.

Memo Note: Credit book holding account vouchers sold for that day.

What is this? It is the $100 in credit being created in the holding account.

.png?width=200&height=89&name=CC%20%20fiserv.%20(3).png)